Pediatric practice and the bottom line

Although pediatricians enjoy caring for patients, there is no disputing the fact that a medical practice is a business that must be run efficiently and profitably.

Although pediatricians enjoy caring for patients, there is no disputing the fact that a medical practice is a business that must be run efficiently and profitably. We must learn to become shrewd businesspeople in order to keep our doors open. This edition of Peds v2.0 discusses financial concerns important to both independent physicians and those employed by hospitals or large health systems.

More and more pediatricians are abandoning private practice because they believe that medical practice has become too burdensome. The Medical Group Management Association reports that two-thirds of physicians were independent practitioners in 2005. By 2008, the majority (52%) were employees.1 According to a recent survey (2012) conducted by Accenture, a medical industry consultative group, only 39% of physicians remain independent.2

According to the Accenture survey, there are many reasons why physicians are leaving private practice2:

- Medical practice is growing more complicated and many fear that healthcare reform will drive most physicians out of practice.

- Most doctors see joining a hospital or health system organization as safeguarding their salaries at least for the near future.

- More than half of doctors cited electronic health record (EHR) requirements as a main reason for leaving private practice.

When you become employed, you have done so because you have a firm belief in the concept of “safety in numbers.” However, as an employee you give up your autonomy. This means that you use the EHR system chosen by the institution, and follow policies established by managing physicians. You may have the ability in such a situation to express opinions and influence decisions, but unlike in private practice, change comes very slowly and policies are often reactive rather than proactive.

So, if you are in private practice, how do you maximize revenue and control costs to ensure that you remain independent? If you are an employed physician, how do you provide quality care and maximize your productivity? Here are my suggestions regarding some best practices that will help you thrive in an era of uncertainty and healthcare reform. You should take comfort in the fact that the need for primary care physicians is expected to increase over the next few years, and those who can prove they provide quality care-whether an employed physician or in private practice-will be in the best position to negotiate contracts with insurance companies or negotiate compensation with their employers.

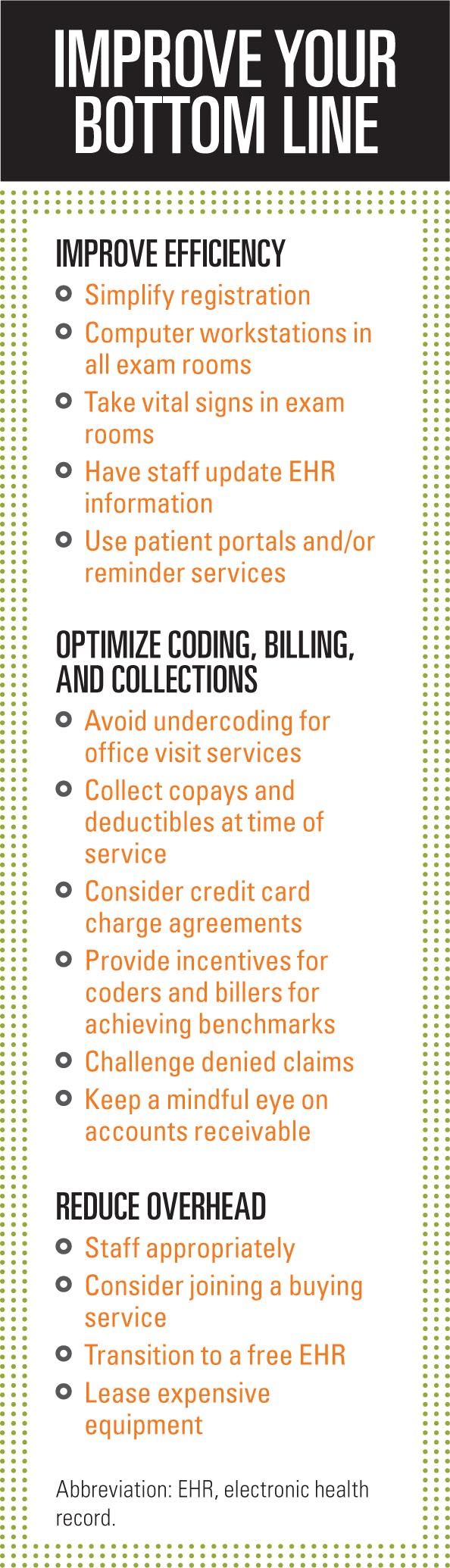

Improve efficiency

No matter if you are an employed physician or in private practice, to survive and thrive in the era of healthcare reform you need to scrutinize your workflow and that of your staff to optimize daily patient throughput. This has been the subject of previous Peds v2.0 articles, and it requires challenging yourself and your staff to think “inside” the box.

It means simplifying the check-in process by shortening patient intake or registration questionnaires; mailing new patient registration forms or using patient portals; and using secure e-mails or online services to remind patients of their appointments.

It means using technology to improve office-based care and screening. Chief among these technologies are photoscreeners and otoacoustic emissions automated screeners to test vision and hearing in your young patients, and office diagnostic tests such as rapid strep tests and rapid influenza testing.

It means that your staff should take vital signs in exam rooms, document the chief complaint, and update medication lists and problem lists so providers can focus on patient care rather than on electronic housekeeping. To facilitate office efficiency, all exam rooms should be equipped with computers running your EHR and printers.

You need to adopt workflow practices that allow you to maximize quality time with patients so you have time to reinforce recommendations.

Optimize coding, billing, and collection

As I discussed in the February 2013 article “Level 4 office-visit coding,” pediatricians are very timid when it comes to coding for the services we provide patients. By simply learning the nuances of documenting to support the level of service provided, you will improve your bottom line and be able to survive any insurance company audit. Studies have shown that physicians tend to under code office visits: 99214 visits are generally reimbursed $30 to $50 more than 99213 visits. These 99214 visits require moderate medical decision making and should be considered when patients present with:

• One or more chronic illnesses with mild exacerbation, progression, or adverse effects of treatment (eg, asthma exacerbation, attention-deficit/hyperactivity disorder not responding to medication).

• Two or more stable chronic illnesses (asthma, enuresis).

• Undiagnosed new problem with uncertain prognosis (eg, blood in the stool).

• Acute illness with systemic symptoms (eg, pyelonephritis, pneumonitis, colitis).

• Acute complicated injury (eg, head injury with brief loss of consciousness).

• Conditions that require prescription drug management (otitis media, urinary tract infection, strep pharyngitis).

Cash flow is the lifeblood of any practice. If insurance companies delay payment, or if you have a slow month, a decline in cash flow may threaten the viability of any practice. To prevent this, you need to optimize cash flow by using an effective billing service or employing experienced coders and billers. Pay your coders and billers well and consider providing cash incentives for hitting certain collection thresholds. Remember that most patients have high deductible insurance plans, so collect payments from parents who have yet to meet their deductibles at the time of service and consider providing a discount when patienets pay by cash or check. When in question, always verify patient eligibility via the insurance company’s website. This usually takes less than 2 minutes.

Many practices have patients sign an agreement enabling the practice to charge a credit card for their portion of the bill once the submitted claim has been processed by the insurance company. Electronic claims should be submitted within 7 days of service for a busy practice and posted within 2 to 3 days upon receipt. Patient bills should be generated within a week’s time of posting. Do not use paper claims because they can significantly prolong the collection process.

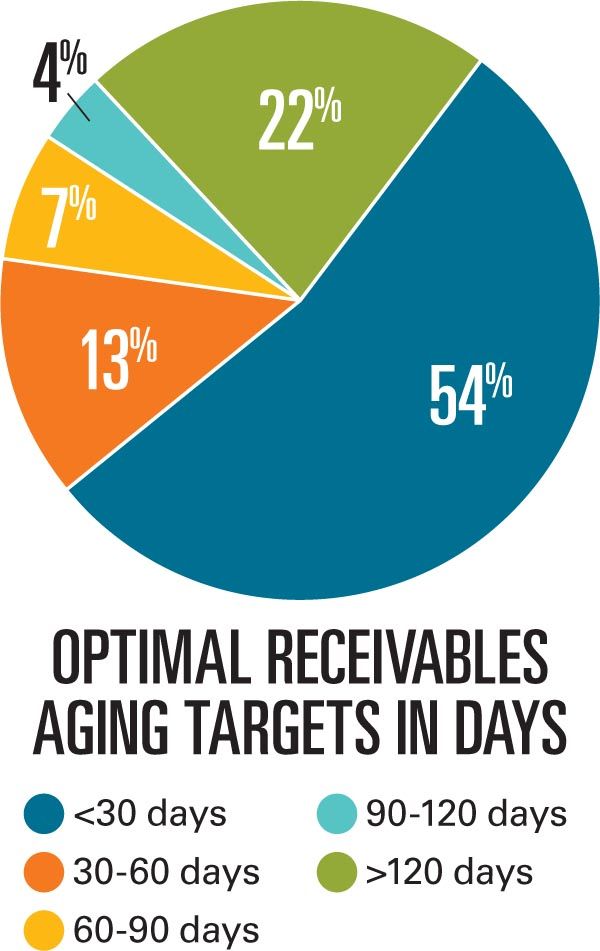

Billing services allow you to outsource your billing, but they collect a percentage of payments or charge per claim processed (or a hybrid of both) whether the bill is paid or not. Many pediatricians prefer to keep billing and collections in-house so they can monitor cash flow and react to problems sooner rather than later. Keep a very close eye on your cash receivables. In general, for a private primary care practice, 54% of your receivables should be in the 0-to-30-day category; 13% in the 30-to-60-day category; 7% in the 60-to-90-day category; 4% in the 90-to-120-day category; and 22% in the over-120-day category.

Never be reluctant to challenge denied claims for charges you believe are appropriate. This is often the case when insurance companies begin to make payments for new services that your practice is beginning to offer, such as developmental screening or visual screening using photoscreeners. It is always helpful to attach American Academy of Pediatrics (AAP) policy statements that support your appeal letters. When you have questions, do some research. A great resource has always been the listserv run by the AAP’s Section on Administration and Practice Management.

Some pediatricians are not aware that you can charge for a well visit as well as a sick visit when your coders use modifiers correctly and you provide 2 notes to provide documentation of your service. This can be done when a patient is discovered to have an ear infection, sore throat, or pneumonia at a well visit, or a new significant problem (eg, blood in stool, palpitations) that will need to be worked up.

It is also important to keep a substantial cash reserve on hand to keep your practice running for several months should collections or productivity decline. If this is not possible, establish a line of credit with a bank that can be used in times of need and paid off in times of plenty.

Keep overhead down

While it behooves all independent pediatricians to be good minders of practice financials, all pediatricians-those employed as well as those in private practice-will benefit if they take measures to reduce practice overhead.

There are many ways a medical practice can reduce costs. Electronic health record systems are extremely expensive, so if you are displeased with your EHR, don’t be reluctant to transition your EHR to Practice Fusion, a free cloud-based EHR that integrates with both cloud-based billing services and desktop billing software. You can reduce your need to send out claims, registration forms, and notices for upcoming patient appointments by using patient portals and/or appointment reminder services. These dramatically reduce overhead, saving postage and time by automating many of the tedious processes that can occupy much of your staff’s time. Most patient portals facilitate payment of bills via the portal itself.

Reduce overhead costs and save money on high-priced items (eg, photoscreeners, copy machines) through financing or leasing agreements that will let you keep up with the latest and greatest technologies because electronics often become obsolete after a few years’ use. Also, investigate whether scribes would be a good fit for your office practice, or look into voice recognition dictation software to save time and effort in documenting your office notes.

Additionally, make sure that you employ the right staff for the office. Don’t hire nurses for duties that medical assistants can easily do, and try to achieve an appropriate number of staff where everyone is busy but not stressed and overworked. Finally, investigate joining a buying service to get discounted rates on frequently bought items for your office such as table paper, syringes, needles, and more.

And keep an open mind

In these uncertain times, if you are in private practice, it is more than appropriate to take an honest look at your financials and practice metrics. Are you seeing as many patients as you did 2 years ago? Is your practice growing or shrinking in terms of enrolled patients? Is your overhead rising?

If you are not thriving, you may consider merging your practice with others in the area. Larger practices have an advantage in controlling costs, negotiating contracts with insurance companies, and centralizing billing and computer operations. If you are an employed physician and you are pleased with your current circumstances and compensation, you should do your best to make your healthcare organization prosper. If you are not happy, keep your eyes open for other opportunities.

Unfortunately, one cannot be certain what medical practice will look like 10 years from now or even next year. For now, we need to take solace in the fact that we take care of a very, very special group of patients.

REFERENCES

1. Beaulieu-Volk D. MGMA: Hospital-employment trend rippling out to affect compensation. FiercePracticeManagement website. Available at: http://www.fiercepracticemanagement.com/story/mgma-65-percent-established-physicians-hired-hospital-owned-practices-2009/2010-06-04. Published June 4, 2010. Accessed August 8, 2014.

2. Accenture. Clinical transformation: New business models for a new era in healthcare. Available at: http://www.accenture.com/SiteCollectionDocuments/PDF/Accenture-Clinical-Transformation-New-Business-Models-for-a-New-Era-in-Healthcare.pdf. Published 2012. Accessed August 8, 2014.

Dr Schuman, section editor for Pediatrics v2.0, is adjunct assistant professor of pediatrics, Geisel School of Medicine at Dartmouth, Lebanon, New Hampshire, and editorial advisory board member of Contemporary Pediatrics. He has nothing to disclose in regard to affiliations with or financial interests in any organizations that may have an interest in any part of this article.